COVID Relief Checks Are In The Mail For Amsterdam

Amsterdam businesses that have already received their money from the US Government have announced that it was easy especially having used the ERTC Express who helped us through all the stages, they helped us determine the amount we were going to receive and they completed all the work with the right forms and proper format of submitting to the IRS.

If you think that this is something you can do yourself, you can try it, but it’s best to let someone else do this work, it can be complex, it can be overwhelming, but as business owners you can write this expense off as a normal business expense. So, save yourself the aggravation and get ERTC Express do the work for you.

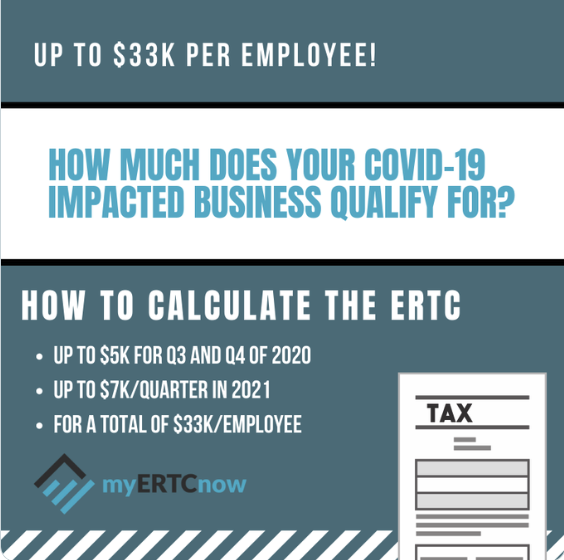

Businesses across the United States are struggling to stay afloat during the COVID-19 pandemic. To help ease the financial burden, the government has implemented a Business Tax Credit called the Employee Retention Tax Credit (ERTC).

This credit is available to businesses that have experienced a decrease in revenue due to the pandemic. Some businesses have already begun to receive their ERTC checks, and the money is being used to retain employees and keep businesses operating. The ERTC is helping to ensure that businesses can weather the storm and emerge from the pandemic stronger than ever.